The excitement of ESG

- February 9, 2021

- Written by Karen Quinn

- 3 years ago

- No Comments

There’s so much to love and get excited about with the current drive and focus on investment sustainability. But, (of course there’s a but…) whilst we’re tripping over ourselves in the industry to join the net zero party, promote ‘greener’ pensions and get behind the climate crisis – let’s not forget the member. The excitement of ESG is ours alone at the minute…

When you bring any product to market, the biggest challenge to overcome is customer inertia. This is especially true in pensions given that ten million savers are only saving because of inertia! The current excitement over net zero investments has the potential to convert that inertia into interest – but it’s not a fast and easy switch.

Actions speak louder than words

In 2019 I stood with tens of thousands of people at Glastonbury and listened to David Attenborough introduce Seven Worlds, One Planet and speak about the climate catastrophe. It was a very special, hairs on end, magic moment in the year that single use plastic bottles were not allowed. The united support for the message was pretty emotional. Afterwards the ground looked like this:

What people say they care about and caring enough to act are quite different. Which means there is quite a journey to make to move from awareness to conversion.

We’ve seen lots of compelling stats that make the case for net zero being a key driver for engagement such as:

– 68% say they want their investments to be used for good in the world

– 86% support sustainable investment

But around 95% of defined contribution pension funds remain in the default fund, according to the Tax Incentivised Association (Tisa).

The slow process of adoption

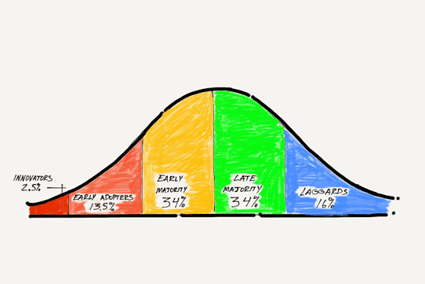

In 1971 Everett Roger explained how, over time an idea, behaviour or product is adopted by a particular group – the analysis resulted in the Diffusion of Innovation – it shows that adoption of the new idea or behaviour does not happen all at once but is a slow diffusion to normalisation and penetration.

A change in behaviour and attitude generally takes a lot longer to diffuse than a product. If we apply this process to the launch of the iPhone – Steve Jobs announced the iPhone in January 2007, it was released 6 months later, selling 270,000 models in its first week. Ten years later around 1.5 billion iPhones had been sold around the world.

Compare this to veganism – The Vegan Society was established in 1944, but it’s only in the 21st century that we’ve seen the animal-free revolution. And even then, the revolution only accounts for 1.16% of the UK population – which in itself is a 300% increase from 2014. The biggest growth is more recent and in younger age groups – 42% of vegans changed their diet in the last year.

How to influence the early adopters...

Roger’s model tells us there are five groups of adopters, whilst the majority sit in the middle groups it’s important to understand the characteristics of all the groups to know who and how to target your ideas. Before I go off on a complete marketing master class let’s bring this back to pensions!

There are five key factors that influence adoption and follow the groups of adopters:

- Relative advantage – how is this better than an alternative? Key for innovators.

- Compatibility – how is it consistent with values, experiences and needs? The drivers for early adopters.

- Complexity – how difficult is it to understand or use? The main motivator for the early majority.

- Trialability – how easy is it to test before adopting? The late majority take some convincing and want to ‘try before they buy’.

- Observability – how can I see the results? Once they are sure it’s a good move the laggards will follow.

Pretty aligned to Nest Insights

In November 2020 Nest Insights released results from an exploratory study on Responsible Investment as a Motivator of Pension Engagement. From analysis of ESG content from other sectors they created 5 principles for effective messaging. These principles broadly follow the five factors above:

- It has to be relevant to me

- It has to come without sacrifice

- It has to be win/win

- It has to be backed up

- It has to be simple

It’s important to remember that different principles will motivate different groups at different stages of adoption. And of course, how messages are framed will also impact the connection and impact made.

Overwhelmed with excitement

The potential for making a difference with trillions of pounds of UK pension investments has got many of us literally jumping up and down with excitement and wanting to tell the world about the power of their pension pound. But in all our excitement we must not forget that we have a largely unengaged population of savers – blissfully unaware of what an investment is, let alone what a green investment might be. It’s easy, in all our excitement, to lose people in a world of unfamiliar acronyms and blind assumptions of knowledge.

Start at the beginning

Whilst the industry is thinking big and looking at the potential long-term benefits of net zero, we need to take small steps with members. They aren’t on the same page yet – a huge number (ten million) are saving largely because of automatic enrolment. And whilst employers must comply with the legislation, they don’t have to educate, and are busily running their own businesses – not providing financial education.

Having a positive impact on the environment with their pension will resonate with some savers more than others. But understanding the basics of how a pension works still needs to be the starting point:

- – You have a pension

- – It’s invested

- – It should grow over a period of time

Just like veganism, there will be segments of your members that a green message will resonate with far more… work on understanding who they are. When you inspire this group to act and engage you will have your innovators and early adopters.

Be mindful of messaging

However powerful the message is, it can be lost in language. What does net zero mean to your members? Have you asked? What about ESG? Here’s a few definitions of ESG acronyms:

Enhanced Service Gateway

Executive Steering Group

Exercise Support Group

Electrostatic Supported Gyroscope

Everyday Street Gangster (rapper)

It can be easy to miss the mark with a message you know, understand and are excited about. But without context and understanding a green message means very little to the people we think will be inspired. So, let’s slow down. Start at the beginning. And allow ESG to be explained and normalised in a language that aids the Diffusion of Innovation process (above!).