Teenage Take over #10

- December 3, 2023

- Written by Luke Quinn

- 5 months ago

- No Comments

It's the 10th teenage take over: We've been out on the streets asking the people of Kingston what they think about pensions...

A few days later than usual, it’s mock exam time and school work comes first – right! This month we went to Kingston to ask people on the street ten questions about pensions. It was quite an experience putting ourselves out there, and we were both a bit nervous at the beginning, but most people seemed quite happy to have a chat to help us…surprisingly

Our gut feel before we get into the analysis

The views and interests of the people we spoke to were quite varied, only one of the 178 people that we asked had done some serious research into pensions off his own back. On the whole most people were mostly uninterested in pensions (the word boring came up a lot). And one lady told us how terrifying pensions were (but she didn’t want to include it as an answer).

We found that the older people were the earlier they thought you should start saving for retirement. And as a rule they were a bit clearer on how much they need to live on each week or month.

Across all ages there was interest but also scepticism when we talked about the planet and pensions. Whilst most people said yes they had a lot of questions (which we couldn’t always answer) about how that works. Some people were very much of the view that saving for retirement and saving the planet were in no-way related.

What the people of Kingston told us

We asked people just ten questions, as we didn’t want to take up lots of their time…

Question 1: How old are you?

31% under 18

10% 19-24

13% 25-35

19% 36-44

27% over 45

We tried to get a perfect balance, but we can only track the answers from the people that spoke to us.

Question 2: Which of these financial products have you heard of?

A reasonable amount of awareness across a range of basic financial products. All good so far.

Question 3: Where do you learn about money and saving?

We chatted about this a fair bit. If people don’t know about pensions (and many of those are parents) – what are they telling their children? How can we break the cycle of low knowledge and understanding?

Question 4: What do you think a pension is?

Just over 11% of the people we spoke to said a pension was a tax efficient way to save. Many asked us what that means!

Question 5: How old do you think you’ll be when you stop working and need a pension?

The majority of people thought they’d stop working somewhere between 61 and 70. Only if they sort their pensions out – right?!?

Question 6: When do you think you need to start saving for a pension?

The older cohort of people we asked definitely swayed this answer with 61% of those surveyed saying 25 or younger.

Question 7: When you hear the word pension which words come to mind?

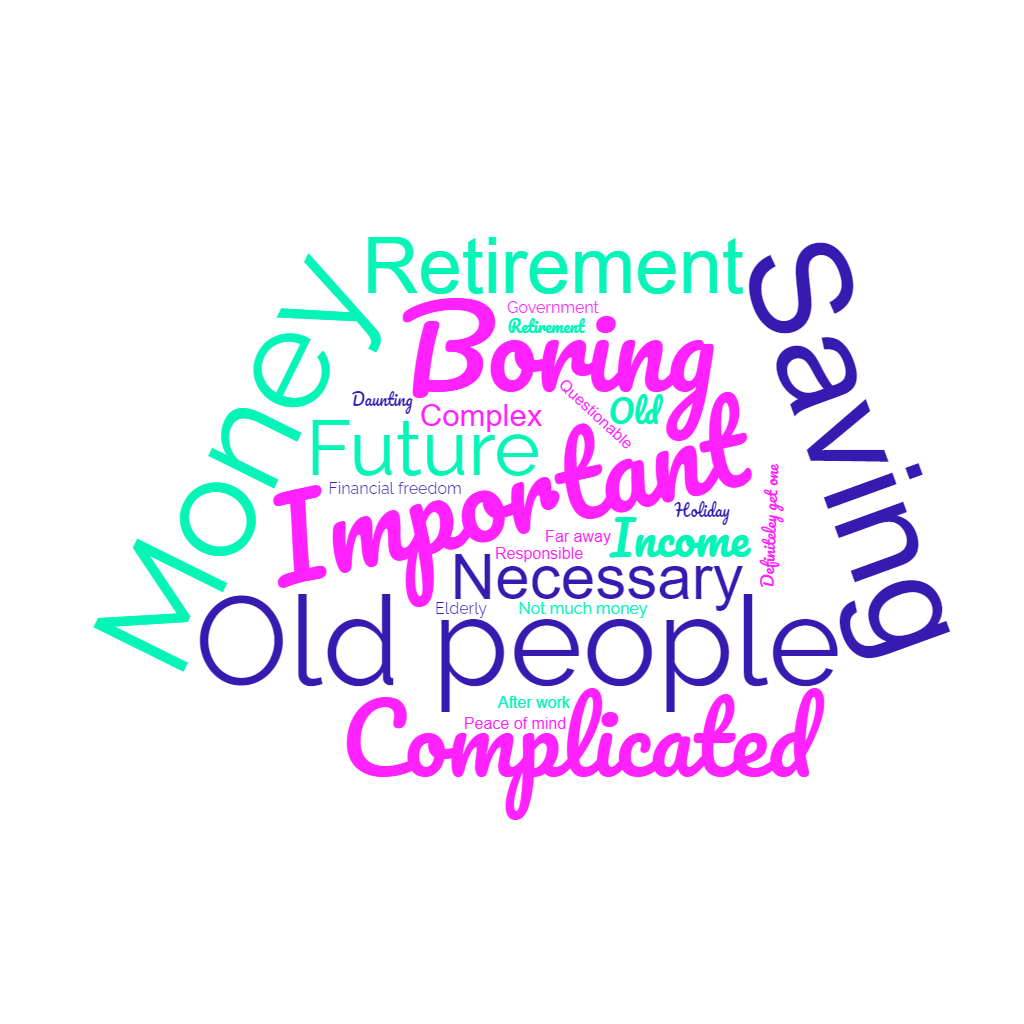

The feel from the street was that even though most people acknowledged they were important, they thought pensions were either too complicated, boring or feel too far away to spend precious time on right now. The people who really wanted to tell us how important they thought pensions are were those who also said they’d left it too late.

Question 8: If you knew saving into a pension could help save the planet would it be more interesting to you?

80% said yes. Nearly everyone wanted to understand how or why. But some didn’t think the two messages should be blurred at all.

Question 9: Do you think you should learn about money at school?

98% said yes. The numbers speak for themselves, almost everyone wanted to know more.

Question 10: How much money do you think you would need to retire at 66?

Well, this was a bit of a learning experience as clearly the question wasn’t structured in a way for us to easily compare answers. Some people gave us a weekly income number (between £200 to £600 per week). Others gave us an annual income figure (between £15,000 and £60,000). And some just gave us total numbers ranging from £20,000 to £4,000,000!

This made us realise that people don’t really understand how their pension will be used or what the numbers really mean.

Final thoughts

Overall we realised that people need more knowledge of pensions (and money in general), how they work, how much they need and how to handle them properly. Then we’ll get less answers telling us pensions are frightening, scary and daunting.

Some people would only speak to us as a couple so they could discuss and work out the answers (it wasn’t a test). It was clear that lots of couples hadn’t really talked about money, savings and retirement together – we’re not sure this is something the pension industry can change. But it’s definitely something society as whole should work on. We need more open conversations about money, this should be something we can ask questions about and not feel dumb.

See you next month…

That’s all for this month! Now a scary thought… next time you hear from us I’ll (Luke) be 16 and it’ll be 2024. So have a lovely Christmas and wonderful New Year everyone.