Influencing behaviours

- June 30, 2021

- Written by Karen Quinn

- 3 years ago

- No Comments

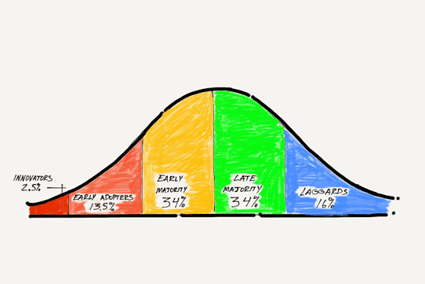

So we’ve looked at the problem of moving from inertia to engagement. We’ve outlined a communications framework to help. Now we’re going to look at influencing behaviours. You may have read my blog on the Excitement of ESG I briefly looked at the slow process of adoption – this is another marketing staple – the Diffusion of Innovation by Everett Roger. Basically showing that a new idea or behaviour is not mainstream immediately, but follows a path of growth overtime:

As we’re looking at moving inertia to engagement – we want to look at the recommendations of how to influence behaviours: What are the key things to include in communications focusing on awareness and interest to attract those early adopters? Roger’s model gives five key factors:

1. Relative advantage

How is engaging with my pension better than watching TV, playing on my phone, exercising. You need to show the difference their engagement makes. Depending on the segment of your audience this could be a cost of delay message, an ESG message or even free money from your employer message. Ultimately you need their time and they need to be compelled to spend it on their pension.

2. Compatibility

How can engaging with my pension align with my values as well as my needs? Understanding what’s important to your members will help you target and frame these messages.

3. Complexity

How difficult is it to engage with and understand my pension? Simple and consistent communications are so important for the early majority, but all that can be undone with a weak member experience. If you have an online account – don’t make members print and sign forms to make an additional contribution. When you’re trying to increase engagement – remove the barriers.

4. Trialability

This is tricky in pensions, but there are ways to demonstrate the impact of increased saving on take home pay as well as share real life stories from members that have made active decisions. Whilst this doesn’t quite offer a ‘try before you buy’ – it does give a real insight.

5. Observability

Can you prove the difference engagement can make? Once they are sure it’s a good move the laggards will follow.

I know it’s easy to sit from afar and spout pure theory on a process without the confines of targets to hit and shrinking budgets. But applying these tried and tested principles to your communications will help you achieve your goals. If you’d like to chat through how, just give me a call.

What’s just as important is the overall communication strategy that will wrap around this. You must get to know your members – research is vital. Along with continual monitoring of results – this will help you to refine and evolve your approach.

Changing behaviours is a slow process

It needs a consistent approach! Think:

- – Don’t drink and drive

- – Get your 5 a day

- – Stay home – protect the NHS – save lives

- – Clunk click every trip

All examples of successful behavioural change campaigns (mostly reinforced with legislation – a good old carrot and stick approach!), that were based on consistent, national, multi-channel messaging. Even so, none of them embedded into part of everyday lives overnight. And messages adapted overtime, based on learnings – let’s look at clunk click every trip as an example:

1965: It becomes compulsory to fit seat belts in the front of cars built in Europe.

1970: “Clunk Click” TV commercials, start – wearing rates very low.

1983: Front seat belt regulations for drivers and passengers come into force.

1989: Wearing rear seat belts become compulsory for children under 14.

1991: It becomes compulsory for adults to belt up in the back.

Up to this point there was adoption of seatbelt wearing, but not saturation. The advertising message was adapted in 1993 to show the danger of not wearing a seatbelt in the back as attitudinal surveys showed people were more likely to wear a seatbelt to save someone else, than to protect themselves!

There has been ongoing adapting of the targeting and messaging to reach those least likely to wear a seatbelt. From Peter Pan to Pizza… yet still it’s estimated around 14% of the population don’t wear seatbelts all of the time!

Decades of national advertising and consistent, targeted messaging, that adapts to behaviours and actions…yet nearly 50 years on around 350 people die each year (and many more injured), because they don’t wear a seatbelt!

One single message?

So, how can we, as an industry create the consistency to build engagement in pensions when we’re all approaching the problem from a different angle? Do we need a national pensions campaign? Is the pension dashboard the catalyst that we’ve all been waiting for, or will COP26 steal its thunder?

Anyway, the point is – we will not create change overnight. We will not get everyone engaged. But we can still make a lot of improvements.

Working on a piecemeal approach

Of course, it’s possible to increase engagement at a scheme level, but the overarching change in attitudes and behaviours towards pension saving and engaging with it will take a lot longer to impact…

As we build messages on a scheme-by-scheme basis and look at behavioural nudges it is possible to build wider momentum by sharing learnings of successes. Creating a bank of effective strategies will build strong foundations for ongoing positive change.

Taking learnings from behavioural science

Marketing is all about influencing behaviours and thoughts… and for some time using a few behavioural science theories has been part and parcel of developing effective messaging. So here’s some key ones to think about:

- Start young: Unfortunately financial education isn’t yet part of the national curriculum, but the younger you can start your awareness communications the better. It’s common for providers to be focused on increasing AUM – your youngest members are unlikely to have large funds or other pots to target transfers in. But they are the pots of tomorrow, so think long term and customer lifetime value.

- Use anchors: The anchoring effect targets the cognitive bias in all of us – as a rule when we place a value on something, that value is set by our own ‘anchors’. When we don’t know the answer we look for it. So if you ask someone how much time they should spend planning their retirement and engaging with their pension and give them an example of someone spending an hour or so a month, the answer they give will be higher than if the example you gave was once a year.

- Give choice, but not too much: Yes, it’s true – too much choice can stop us from making any decision at all. When our brains are faced with complex or large choices it can lead to anxiety and a focus on what we don’t have rather than what we do have. So if you’re asking members to make investment decisions instead of asking them to choose from all your funds help them to narrow the choice through a series of qualifying questions.

A collective approach

The purist definition of engagement focuses on the use of strategically created content to add value and develop meaningful interactions overtime. If we’re serious about increasing engagement and influencing behaviours here’s some critical steps:

- – Define what we mean by engagement

- – Understand where we are now

- – Set some goals

- – Agree a common approach to messaging

- – Start with adding value and building trust

- – Share results across the industry

This is what must happen to prevent generations of under-resourced retirees. We need seismic shift in attitudes and behaviours…something the whole industry must work together to achieve.